WHAT WE DO...

We work with families to plan and safeguard the future for people with disabilities

-

WE PLAN FUTURES

From "What if?" to "Here's how." Every day, we introduce families to the security of our special needs trust program.

-

WE MANAGE TRUSTS

We're there for our trust clients.

We listen, support and guide them every day. -

WE SUPPORT

Our diverse team is trained in matters related to financial management and disability services. We are passionate about supporting you to meet your goals. -

WE EDUCATE

Come to us for webinars, question-and-answer roundtables, online videos, downloadable resources and referrals to knowledgeable experts.

Our Mission

About the Special Needs Trust from The Arc of Northern Virginia

The Arc of Northern Virginia Personal Support Trust is for people in Maryland, Virginia and Washington, D.C.

We manage all of the pooled special needs trusts for our Trustee, Key Bank. We are experts in finance and disability policy. We know, care for and understand people with disabilities. Serving the community is our mission. That makes us the ideal partner to set up and manage your trust.

Welcome! We look forward to serving you and your family

Program Highlights

Knowledgeable Staff

Our staff trained are trained in matters pertaining to both financial management and disability services.

We constantly monitor for changes in regulations. In other words, we stay up to date on the rules, so you don't have to!

Meet Our Team

Caroline Girgenti

Client & Community Relations Specialist

caroline.girgenti@thearcofnova.org

703-208-1119, Ext 139

Affordable Fees

We want our services to be accessible to all families. We offer competitively low fees and seed funding requirements.

Sub - accounts can be established "unfunded".

Minimum amount to fund a sub - account is $500.

Fees are subject to change with proper notice.

Our current fee schedule is as outlined below.

One Time Fees

Annual Fees

Experienced Trustee

We work with Key Bank, a Trustee that has expertise in both investing and Pooled Special Needs Trusts.

Key Bank currently offers the following four different investment options for any sub - account funded with a minimum of $1, 000. Sub- accounts with a balance of less than $1, 000 will be kept as cash equivalents.

Investment Objectives

| Option | Return Objective | Risk Tolerance |

| Cash Equivalents | Appropriate for investors who desire no principal volatility with competitive market returns. | Low – Preservation of principal is sole objective. |

| Income / Growth | Appropriate for investors who desire moderate growth, modest current income and have an Average risk profile. | Average – Average principal risk with average inflation protection |

| Balanced | Appropriate for investors who desire moderate growth, modest income and have an Average/Above Average risk profile. | Average/Above Average – Moderate to above average risk with above average inflation protection. |

| Growth / Income | Appropriate for investors who desire moderate growth with a secondary provision for income and an Above Average/High risk profile. | Above Average/High – Moderate to above average risk with above average inflation protection. |

Allocation Guidelines

| Option | Cash | Equity | Fixed Income | Real Assets | Alternatives |

| Cash Equivalents | 100% | 0% | 0% | 0% | 0% |

| Income / Growth | 0% - 20% | 30% - 50% | 45% - 65% | 0% - 10% | 0% - 20% |

| Balanced | 0% - 20% | 40% - 60% | 35% - 55% | 0% - 10% | 0% - 20% |

| Growth / Income | 0% - 20% | 50% - 70% | 25% - 45% | 0% - 10% | 0% - 20% |

More About Key Bank

KeyBank serves as Trustee of our Special Needs Trusts and handles paying bills, writing checks and ongoing investment management.

The Home You Know

KeyBank can hold real estate in a special needs trust. That helps protect a beneficiary's sense of home and their disability benefits. We are the only special needs trust program in the Washington, D.C., area that can integrate real estate among trust assets.

A Stable Future

With its various investment options, KeyBank helps meet trust portfolio investment objectives. It's a mix of financial resources and goals, risk preference and rate of return goals.

Estate Settlement

KeyBank can settle an estate as the executor, co-executor, personal representative, or co-personal representative. KeyBank will also serve as successor trustee. Our relationship with KeyBank is unique. The team works with clients to develop a focused, personalized approach to managing investments and planning for the future.

Seamless Processes

Transfer stocks and investments to your special needs trust in-kind without cashing them out. KeyBank works with you and your financial institution to ensure a smooth transition.

Accountability

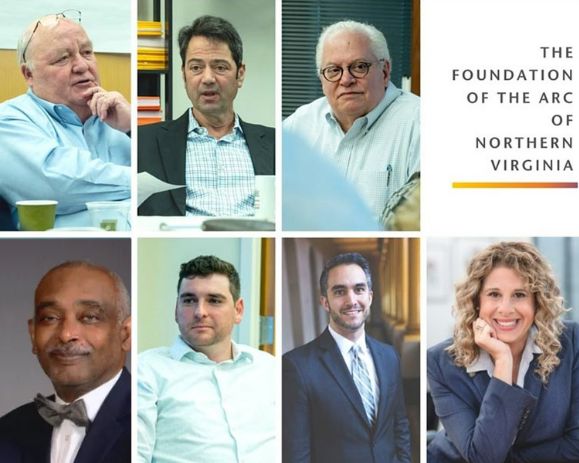

The Foundation of The Arc of Northern Virginia oversees our special needs trust program adding an additional layer of expertise and accountability.

The Foundation manages The Arc of Northern Virginia's endowment. Employees of The Arc of Northern Virginia serve as managers of the special needs trust program for beneficiaries and their families. The Director of Trusts reports to the Foundation Board.

Members of the Foundation seek people and organizations that might want to support The Arc of Northern Virginia.

Our Members of the Foundation board are experts in disability issues and money management. The board meets every month along with KeyBank financial advisors to discuss investment strategies and client relations.

About The Foundation

Foundation Board Members

- Douglas Church, Jr, Chairperson - Retired, Virginia Heritage Bank

- Alan Harbitter, Past Chairperson - Harbitter Consulting, LLC

- Alexander Yellin, Secretary - CNA, Research Analyst

- Michael Zoskey - Morgan Stanley Financial Advisor

- Jouya Rastegar - Attorney at Law

- Melissa Heifetz - The Arc of Northern Virginia Executive Director

Pro Bono Legal Counsel

Elizabeth L. Gray, Principal, McCandlish Lillard

Let's Talk About the Future

Take the first step toward creating a Special Needs Trust for a loved one with a disability.

Join us for Trust Talk Tuesday to start the establishment process!